Investment trust STS Global Income & Growth is not designed to shoot out the lights. Far from it.

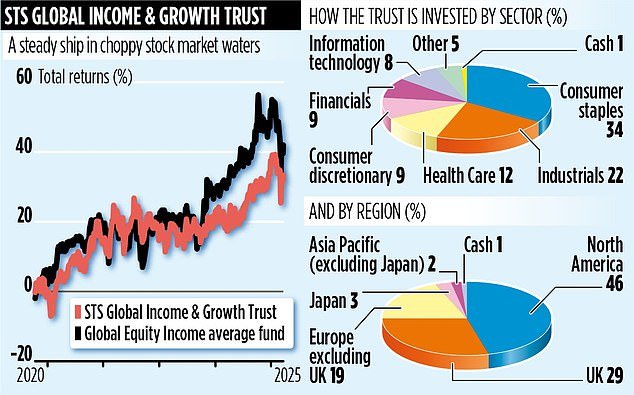

Since Troy Asset Management took over its reins in late 2020, it has been more defensive than attack-minded – happy to provide a rising flow of income to shareholders while gently enhancing the value of investors’ capital, and preserving it when stock markets plunge.

It’s a conservative investment approach which has worked so far. Since November 2020 it has generated a return – a mix of capital and income growth – in excess of 35 per cent.

While this is below the average 43 per cent return for its global equity income peer group, senior fund manager James Harries says the £287 million trust is doing exactly what the portfolio was set up to do – steering a steady course through ups and downs. He runs it with colleague Tomasz Boniek.

‘We want STS Global Income & Growth to be a high quality, low volatility trust in the global equity income space,’ says Harries.

‘That means running a concentrated portfolio of exceptional, resilient companies which are capable of generating sufficient income to support growing dividends. We see our core shareholders as having a requirement for income while not wishing to see their capital depleted – that is what we are trying our hardest to deliver.’

In terms of income, the trust’s annual dividend is moving in the right direction.

While the payment was cut in the financial year they took over management of the trust – ‘a necessary resetting,’ insists Harries – it has ticked up gently over the past three years, from 5.7p a share to 6.54p.

Three years should become four in the next few weeks or so when the trust reports its final quarterly dividend payment for the financial year ending March 31 (dividends paid so far this year total 4.758p).

As far as capital depletion is concerned, it has been far more resilient than its peers recently.

Over the past six months the trust has recorded a gain of 5 per cent compared with the 3.2 per cent loss by the average for its peer group. At other times when markets have declined – for example, at the start of the Ukraine war in 2022 and later in the same year when interest rates rose suddenly – it has proved equally resilient.

The trust is currently invested across 31 companies, with its only exposure to the ‘magnificent seven’ US stocks – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla – being in Microsoft.

Though Harries says it is difficult to make predictions about the future for markets or the world economy, given President Donald Trump’s unpredictability, he believes there is the likelihood of a recession in the United States, explaining: ‘We are due a more difficult period.’

In recent months the trust has taken stakes in a number of new stocks. These include Spanish IT company Amadeus, UK pest control specialist Rentokil, German tech company Siemens and US sportswear giant Nike.

Harries says: ‘Nike’s shares are a third of the value they were trading at in late November 2021. The company may have to shift some of its production away from Vietnam if Trump’s tariffs remain in place, but it has sufficient pricing power to withstand what the President puts in its way.

‘At the end of the day, it remains a quality business – and that is what I am interested in holding under the bonnet of STS Global Income & Growth.’

Annual trust charges total 0.77 per cent, its market ticker is STS and identification code B09G3N2.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.