The growing number of investors helping banks offload illiquid risks from their structured products books have successfully weathered their first test of these complex strategies since the early days of the pandemic following this month’s short-lived surge in equity market volatility, say market specialists.

The number of hedge funds and other investors engaging in alternative risk transfer trades has roughly doubled this year, after a sustained period of low equity volatility sapped profitability from other investment strategies and attracted more interest in these niche transactions.

While this increased appetite has helped fuel a rapid expansion in banks’ structured products issuance over the past year or so, it’s also left these specialist investors exposed to risks that can be fiendishly tricky to handle in choppy markets – such as the stock market volatility surge seen in early August.

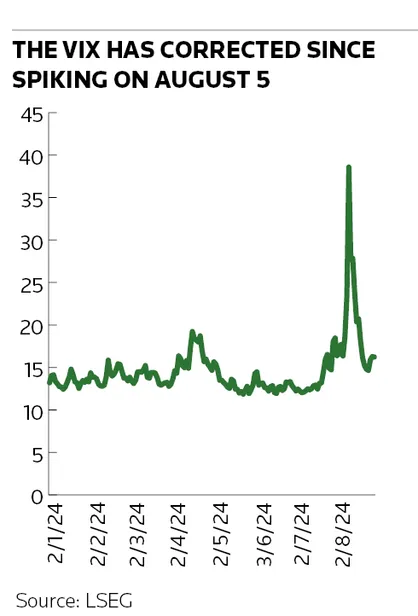

Cboe’s Volatility Index – often known as Wall Street’s fear gauge – rocketed to an intraday high of 66 points on August 5, from as low as 12 points in July, after a selloff in Japanese stocks cascaded across the globe. By August 8, however, the VIX had retraced to about 28 points. Such a fast recovery meant that the risks typically faced by ART investors during volatile market periods were short-lived.

“The market moves we saw earlier this month weren’t strong enough or big enough to warrant liquidating ART positions or trigger a risk review among ART clients,” said Steve Nawrocki, head of equity derivatives for the Americas at BNP Paribas. “Ultimately, this month’s volatility was a small bump in the road. There’s since been a healthy retracement and the market will probably be stronger from now on.”

Appetite for ART remained strong during the four days of market volatility, with some banks actually seeing a surge in demand for ART trades as greater levels of volatility made certain ART positions cheaper to enter, say traders.

Wake-up call

The short-lived rise in volatility may nevertheless deter some investors from adding to their ART positions, or entering ART trades for the first time, warned an equity head at an American dealer.

“People have become more aware about market fragility and so I would expect to see a bit more investor reluctance to pile up their ART risks,” he said. “This month’s volatility spike was a bit of a wake-up call that these market moves can happen and that the risks from these trades can materialise – even if only for a short period of time.”

ART hedging has a chequered history for investors brave enough to dabble in the space, with one of the most active investors in ART, Canadian pension fund AIMCo, losing C$2.1bn (US$1.5bn) in early 2020 when stocks slumped at the start of the pandemic. Other funds active in ART were forced to leave the business for good, licking their wounds.

That episode provided a clear warning of the dangers involved in what essentially amounts to selling banks crash protection for parts of their structured products books. ART trades typically involve hedge funds receiving a chunky coupon payment from banks for absorbing risks – such as volatility and correlation – that banks would otherwise have to hold.

It’s not hard to see why banks are keen to see funds taking on these risks. Some of the biggest banks in structured products also suffered huge losses following 2020’s violent market moves as these products typically become extremely difficult to manage when equity markets take a sharp tumble.

Vol spurs volume

Alongside increased demand for ART, this month’s short bout of market volatility also encouraged more market participants to purchase structured products – a product set that has also seen growing client demand this year.

Many investors purchased notes linked to stocks that were most affected by the selloff – such as shares of AI-related companies – in the hope that they would profit from a rally once market volatility subsided, said Nawrocki. “Which they clearly did,” he said.

At Citigroup, the biggest increase in structured products activity came from private bank clients trying to capture higher incomes from volatile market moves, said Guillaume Flamarion, head of its multi-asset group in the Americas.

While activity from these clients pales in comparison to the volume of structured products typically executed from mass retail clients rolling their money into new notes once their structured products get called, Citi nevertheless saw “a decent increase in structured products activity from private money clients” during the turbulence, said Flamarion.

“Private banks usually pick up their structured products activity during periods of increased volatility, which is exactly what we saw this month,” he said.