Launched in 2017, the investment platform Masterworks has made investing in contemporary art accessible and streamlined—pioneering a new way of engaging in the art market. Recently, Masterworks announced the acquisition of its 250th painting, itself an exciting benchmark in the company’s holdings that also heralds the steady expansion of its collection.

Traditionally, investing in fine art has often been an incredibly nebulous and opaque process, necessitating insider knowledge and connections. But that hasn’t stopped the everyday investor from wanting to engage with the art market as a means to diversify their portfolio. Masterworks has forged a new way for investors to take advantage of art as an investment opportunity by taking out the guesswork, offering individuals the chance to buy and trade shares of iconic art sourced and vetted by their top-tier research and acquisitions teams—artworks that, for many, would otherwise be out of reach. Acquiring art from dealers, advisors, and collectors directly, Masterworks has crafted a diverse collection of high-value art that each member can benefit from its overarching appreciation.

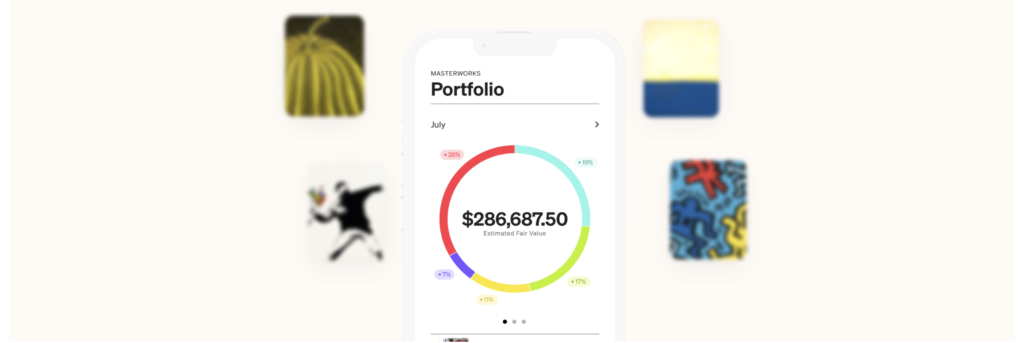

Courtesy of Masterworks.

Masterworks CEO Scott Lynn says, “Contemporary art has outperformed the S&P for the past 26 years, but there has been no way to invest in it. Masterworks is the first company to offer art investment products to the retail investing public.”

Part of Masterworks’ success can be attributed to the diversification of artist markets it engages with. Focusing primarily on blue-chip artists with established reputations and growth potential—with valuations between $500,000 and $25,000,000—Masterworks currently buys from over 100 different postwar and contemporary artists markets. Some examples of these include:

- Alighiero Boetti

- Alma Thomas

- Carmen Herrera

- David Hockney

- Edward Ruscha

- Gunther Forg

- Helen Frankenthaler

- Joan Mitchell

- Jonas Wood

- Julie Mehretu

- KAWS

- Kazuo Shiraga

- Laura Owens

- Liu Ye

- Lynette Yiadom-Boakye

- Matthew Wong

- Nicolas Party

- Nina Chanel Abney

- Park Seo-Bo

- Pierre Soulages

- Yoshitomo Nara

Whether you’re a seasoned art collector or an investor new to the art market, Masterworks offers a seamless and straightforward opportunity to take advantage of fractional art investing—and diversify your portfolio with art by some of the world’s most famous artists.

Collectors and advisors interested in selling works to Masterworks should email acquisitions@masterworks.com.