Speculation and investment are two delicate subjects in the art market, but they are hardly novel topics. In a market celebrated for breath-taking prices for branded art trophies, art is seen as a potential hedge, an addition to an investment portfolio. There has been no shortage of attempted innovations to invest in and profit from art. Scores of funds, modeled on investment funds, have been launched . . . and failed. Today, art-buying partnerships are more common investment vehicles, where two or more people or businesses own a piece of work. Even Henri Matisse, the French painter, outlined a plan in 1903 to start “a small syndicate that would give me enough money to work for a year.” Matisse’s idea may have been the impetus for the best-known art investment venture, La Peau de l’Ours or “The Skin of the Bear.”

As early as 1895, André Level—an enterprising lawyer and financier—was a gallery goer, who operated within a network of artists and commercial galleries, including that of the French art dealer Ambroise Vollard. Level was also secretary of the board of directors of the Docks and Warehouses of Marseille and director of the French Society of Transport and Refrigerated Warehouses. It may be fair to speculate that his day jobs around docks and warehouses prompted Level to think of art in terms of commodities. If art existed to be bought and sold, then it may have been like any other product to him. It would seem logical to believe that one could invest in art and make money.

As the 20th century began, shrewd collectors—pioneers—were buying contemporary art, even though contemporary art was treated with skepticism. Historically, the markets for Impressionism and Post-Impression were hardly overnight successes. Prices were low for decades and only began to uptick in the early 1900s. There began a greater investment opportunity with emerging art rather than established art. In many cases, the supply exceeded demand.

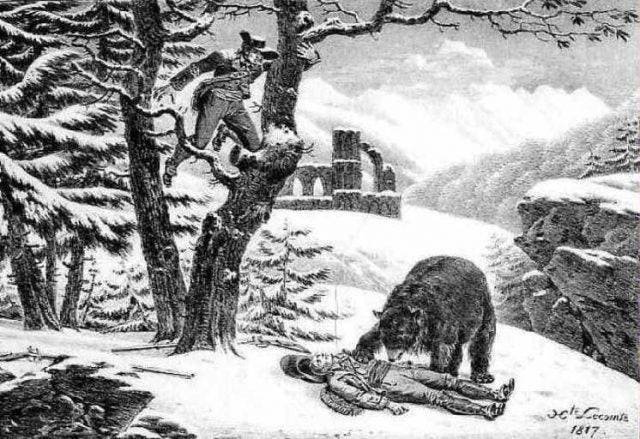

It has been suggested that Matisse’s plan inspired Level to organize a syndicate in 1904, the aim of which was to buy affordable works by emerging and under-appreciated artists over a period of 10 years. Then, the collection was to be sold in one auction. The premise of Level’s syndicate (or consortium) was a simple one: betting on the future, assuming a high level of risk. This risk was underscored by the syndicate’s name, La Peau de l’Ours, which was appropriated from a tale written by the 17th century French fabulist Jean de la Fontaine. The Bear and the Two Companions (L’Ours et les deux Compagnons) reads:

Two fellows pressed for cash, averse to labor, Sold a bear’s skin to a Furrier, their neighbor –

[The] Skin of a bear was uncaught and living still, But one, they said, they were about to kill

“The very king of bears,” they cried, “You’ll make a fortune by his hide.”

Level was reputedly hard-pressed to find investors outside his personal network of family and friends, many of whom were art lovers. In reality, the syndicate was a model of buy-and-hold investment and risk sharing. Over the ten-year life of the syndicate, its 11 voting partners (two partnerships were co-owned by brothers) were allowed to “decorate the walls of their home” [sic], making an annual choice using a lottery system. But, exchanges and other loans or trades were also commonplace among the co-investors.

Level shifted the collectors’ perspective towards little-known artists. As the partners later explained, established works that had been validated in the market had become increasingly rare and expensive. New art or rediscovered art offered the syndicate an opportunity to invest in the future, increasing the opportunity for profit. These artists included young and under-recognized, talents like Dufy, Gauguin, Matisse, Picasso, Redon and Van Gogh. There was a pragmatic concern too. There was less risk of forgery with emerging art.

Level was the syndicate’s manager and arbiter of taste. He was responsible for selecting and acquiring the paintings. But to make an acquisition, Level had to have the assent of a majority of three syndicate members, his advisory council. Since Level held one of the three council seats, assent was easy. The partners relied on his expertise and his access to artists’ studios and galleries. Individual partner contributions were 250 French francs, paid annually to a pooled trust. The fund flourished, acquiring well over a 100 paintings and drawings over time.

©2017. Image courtesy of http://www.vangoghroute.com/france/paris/hotel-drouot/.

A public sale was held at the Hôtel Drouot, a “dowdy, municipal” Parisian auction house, on March 2, 1914. It was the first time that many 20th century artists—like Picasso—were tested at auction. Far from a discrete enterprise, Level’s auction was well advertised, attracting dealers and artists alike. Apparently it was a dry affair, “precise and nervous,” as most auctions are. As one account recalled: “There were many picture dealers and amateurs, the young painting is more interesting than we think, there were also a large number of artists, the ones we sold, their comrades and their friends.“ The journalists who reported on the sale, did so with variable sympathies, ranging from amused to friendly. Some reporters were allegedly “sworn enemies of modern painting” and were indignant at the prices achieved, especially by Picasso. Maurice Delcourt, for example, unleashed a vindictive against “undesirable Foreigners, responsible . . . for the decadence of French art.”

Of the 145 works in the auction, the sale showcased 12 works by Picasso and 10 by Matisse, both of whose paintings attracted the highest bids. The auction earned a total of 116,545 French francs. Picasso alone generated 31,301 French francs in sales. Matisse’s 10 works in total brought in 17,928 French francs. The syndicate’s statutes were pragmatic and included several innovative provisions. The partners were paid an initial distribution of 3.5% of the auction’s profits. Then a management payment of 20% was made to Level. The provisions also stipulated that the artists or their estates would also receive a royalty—20% share of profits (net of expenses)—anticipating what is now termed droit de suite. This auction was the first time that many 20th century artists—like Picasso—were tested at auction. The auction heralded one of the earliest and, to this day, one of the few broadly acknowledged successes of a speculative art syndicate. La Peau de l’Ours presaged art investment funds that emerged in the 1970s, like the British Railways Pension Fund.

Perhaps Level’s greatest achievement was the auction price achieved for Family of Saltimbanques, which Level had purchased from Picasso for 1,000 French francs. Because of its size, the painting had languished in a coach-house until the auction, when it sold for 11,500 French francs, a sum significantly higher than its estimate of 8,000 French francs. It was purchased by Heinrich Thannhauser, the Munich dealer, who in turn sold the work to the infamously private Herta Koenig. Family of Saltimbanques was resold in 1931 for $100,000 to Chester Dale, a reputedly pugnacious New York American banker, who bequeathed this painting and his collection to the National Gallery of Art in Washington, DC.

It is easy to forget how recent “modern art” is and how the market has developed. Pablo Picasso, the artist whose name is synonymous with modernism, only had his first show in Paris around 1901 and in the United States in 1911. It was only after The International Exhibition of Modern Art (The Armory Show) in 1913 that Picasso began to earn appreciable recognition. But in terms of auction visibility and prices, Picasso only gained attention in 1914, in part as a beneficiary of early art speculation by André Level. Today, Picasso is a bellwether for the health and wealth of the global art market.

In the contemporary art market, informal partnerships have replaced formal syndicates and the majority of art funds. Partnerships let artists, collectors, gallerists, private dealers and other investors co-own a work of art, share risk and, perhaps, divide profits. The potential return on any art investment, however, is incalculable. La Peau de l’Ours‘s had a total investment of 27,500 French francs over a ten-year period. Its gross auction results before fees and distributions were 116,545 French francs. The syndicate made no one wealthy, but by showing the influence of Level’s “good eye” along with his investment strategy culminating in a public sale, he took Picasso’s and Matisse’s careers to new heights. La Peau de l’Ours made art history a richer story.

![Hippolyte Lecomte and Charles Lasteyrie. L'ours et les deux Chasseurs. 1781/1857. Musée Jean de La... [+] Fontaine de Château-Thierry.](https://blogs-images.forbes.com/claytonpress/files/2017/10/m078402_0002003_p-e1508866395435.jpg)