Sotheby’s Asia, which is headquartered in Hong Kong, recently auctioned a Chinese painting from the imperial era. Bidding had reached the tidy sum of $320,000 and Kevin Ching, the company’s CEO, was on the phone to a client on the mainland. All of a sudden his client made a much higher bid. Ching checked there was no mistake then passed it on to the auctioneer. “It’s part of the process. The Chinese are growing up and getting rich,” says this former corporate lawyer.

He adds: “We have exuberant customers. They can be very impatient. Even at an auction, they don’t want to waste time.”

In this field, as in others, the Chinese are redrawing the maps. According to Artprice, a specialist in art market information, the volume of sales, just for fine art, at public auctions in mainland China has rocketed in barely 10 years to reach 41% of the global market in 2011: the biggest share in the world.

When a sale of Chinese art is held in Hong Kong, London or Paris the room is full of Chinese buyers. They are taking a keen interest in watches, jewellery and wine, too. A revolution is in progress. “It’s the biggest thing in the art world in 20 years. We have moved from a standoff between the United States and Europe, to a three-cornered confrontation, making it a truly global market,” says Guillaume Cerutti, head of Sotheby’s France.

In 2011, two Chinese artists topped the annual ranking of auction revenue established by Artprice, with about $530m for Zhang Daqian (1899-1983), a traditionalist painter and a very gifted forger who spent much of his life in exile, and $465m for Qi Baishi (1864-1957), who was favoured by the Communist leadership. Andy Warhol was relegated to third place.

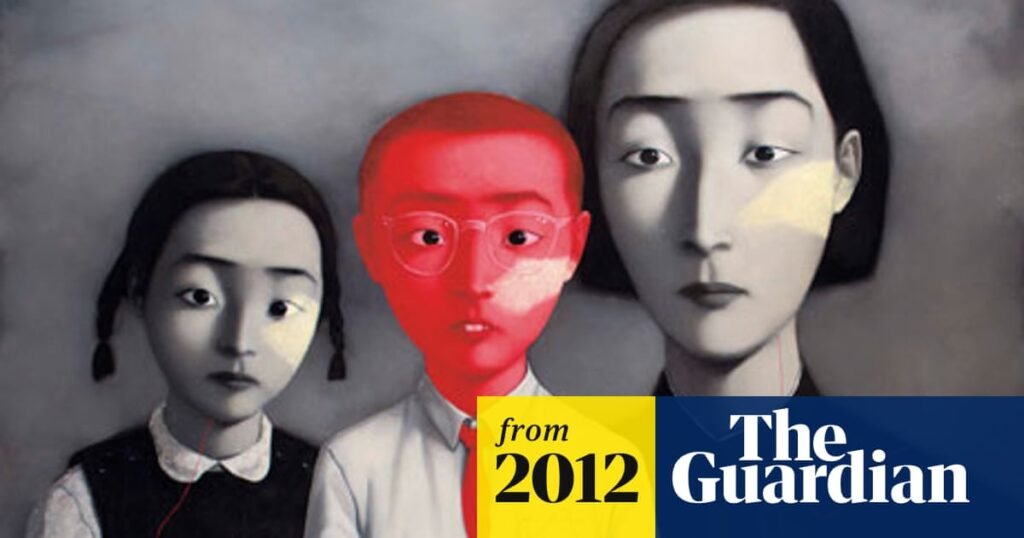

Turning to the 10 most expensive works by living artists in 2011, we find three Chinese alongside Damien Hirst and Jeff Koons. A recent work by traditionalist painter Cui Ruzhuo fetched $16m at Christie’s Hong Kong. Hot on his heels come two contemporary art stars, Zhang Xiaogang and Zeng Fanzhi.

The main reason the art market in China is booming is because there are more and more dollar millionaires – 1.1 million in 2011, according to the Boston Consulting Group. But this poses a challenge for Christie’s and Sotheby’s, which have dominated the world market for years. It is a godsend too. The two auction houses are not allowed to organise sales in the People’s Republic, but they have cornered the Hong Kong market, a key centre for Chinese art. Buyers from the mainland now account for 40% of sales by Sotheby’s Asia, up from 4% barely five years ago.

The two companies pride themselves on their expertise, which enables them to control “all the top quality Chinese art”, says Ching.

Although they cannot sell in mainland China, the two companies can exhibit in leading hotels in Beijing and Shanghai, tempting buyers to attend auctions elsewhere. Sotheby’s has just staged its first show in Chengdu and now produces its websites and print catalogues in Mandarin Chinese, as does Christie’s. “For the past two years we have had a Chinese concierge and staff who speak the language to take care of Chinese clients visiting London or New York,” says François Curiel, head of Christie’s Hong Kong.

The new interest in their art displayed by prosperous Chinese has introduced them to other fields. “There is a huge reserve of collectors, and therefore buyers,” Curiel adds. “On their travels they learn about people like the Rothschilds or Rockefellers, and the museums and foundations they founded. They will follow suit, developing an eye for art, taking an interest in art nouveau, photography, furniture and ultimately contemporary European and US art.”

A few rich Chinese artists have been among the first to buy western art. One of them recently contacted French galleries with the idea of building up a collection to explain the development of western painting from the 19th century to cubism. In Hangzhou, south-west of Shanghai, the China Academy of Art is preparing to host a permanent collection of objects and drawings from Germany’s Bauhaus, acquired in Germany last year for $72m.

The market for Chinese art is so huge and diverse that in China it is attracting investors disappointed by other sectors such as the stock market or property investments.

Seven of the world’s largest auction houses are in China. Poly International, the largest rival to Sotheby’s or Christie’s, started trading in 2005. The oldest one, Guardian Auctions, based in Beijing, opened in 1993. A year later CEO Wang Yannan travelled to New York in search of foreign buyers, only to realise that its clients were closer to home. “We still travel abroad, but to find works to take home,” she says.

Last autumn there was a dip in prices fetched at auction. “It’s a good sign,” Wang says. “Things were going too fast. For the past five years profits have doubled annually.”

This article originally appeared in Le Monde