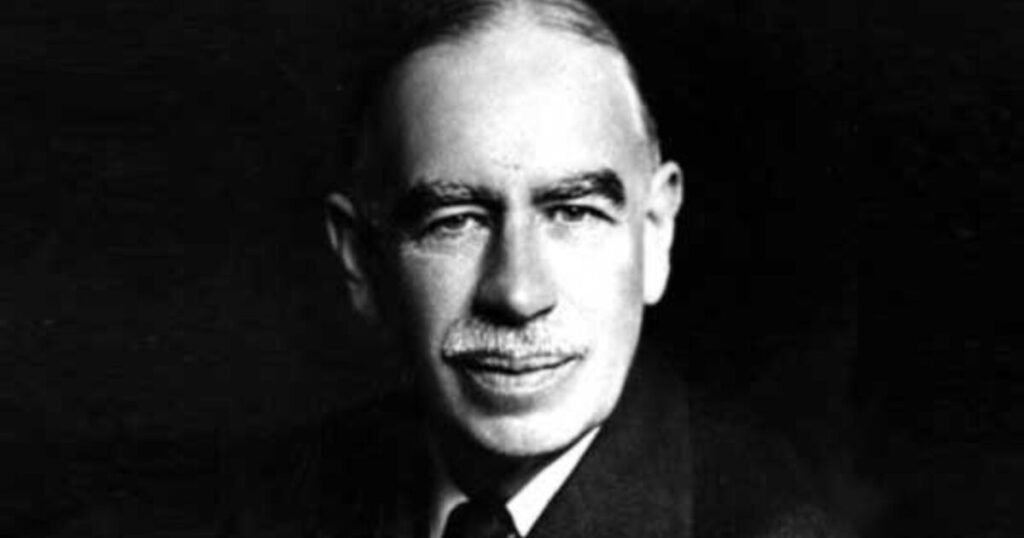

The famed early-20th-century economist John Maynard Keynes is perhaps best known for challenging the reigning orthodoxy that free markets generate full employment, arguing instead that the state has a role to play in helping moderate the swings of business cycle. His work—not just theoretical but practical, in the many roles he assumed on behalf of the British government—laid the foundation for modern macroeconomics. His ideas still influence policymakers today, especially those calling for government spending, or stimulus, in times of low economic growth.

But that was just one facet of this mustachioed polymath who often spent his mornings working in bed, propped up by pillows and surrounded by books and papers, and nights dashing about London with its famed Bloomsbury Group, a group of artists, writers and thinkers that included the likes of Virginia Woolf and E.M. Forster. Keynes was an art lover and supporter, a friend of artists, and a canny art collector, whose collection of 135 works was bequeathed to Cambridge University’s King’s College.

It’s that slice of his extraordinary life that economists David Chambers, Elroy Dimson, and Christophe Spaenjers studied for their working paper, “Art Portfolios,” to better understand the long-run performance of art as an asset class. Keynes’s “portfolio,” or art collection, was amassed for less than £13,000. By 2013, it was valued at over £70 million, for an annualized real rate of return of 4.2% over the past half-century—virtually matching the performance of the total return on equities over the same period. So what does their analysis tell us about the art market?

By analyzing the performance of Keynes’s collection, and comparing it with the simulated performance of thousands of hypothetical art portfolios, they found that the art market was structured much like a lottery, with relatively few winners (artists and their collectors) reaping enormous gains, and the bulk of artists marginal to the overall value of the market. This will be entirely unsurprising to anyone who has stood on an Christie’s or Sotheby’s saleroom floor or perused the aisles of major art fairs like Art Basel or Frieze.

The art market has also largely eluded various attempts to estimate, measure, and index it. Historically, around half of transactions happen in the private market (in recent years that figure has crept higher), but publicly available auction records only include prices for works that successfully find a buyer. This can skew estimates of returns in auction-based indexes, although the exact nature of this bias is still being studied. In addition, consignors tend to sell works at auction when they expect a high return, meaning that auction-based indexes may overestimate returns due to this “selection bias.”

Keynes’s portfolio is somewhat unique in entirety avoiding these pitfalls, according to the authors. “It is one of only two complete, or near-complete, financial records of an art collection from initial purchase to final valuation,” they wrote, adding that it is the only one that also includes valuations at other intervening points in time. The other, the collection of Victor and Sally Ganz, auctioned at Christie’s in 1997, was noted for its “extraordinary financial value,” while Keynes’s collection, by contrast, had no particular renown. It also came with extensive documentation of the purchases and why he made them.

“To our knowledge this was the only one where we could really observe purchase decisions by an art portfolio, then track the value of the collection’s items over time,” said Spaenjers, an associate finance professor at the business school HEC Paris. “You see all these decisions being played out over many decades.…You can see how his purchase decisions changed with his personal fortune.”

And while it was not sold off, the collection has been valued over the years by insurers, auction houses, and finally through independent appraisals ordered by the study’s authors in 2013.

“In creating indexes, they’re always hypothetical,” said William Goetzmann, a Yale University finance professor who has previously collaborated with Spaenjers. “Lots of us have spent time trying to do indexes, but we really don’t know whether those represent the true return to investing…this has the special virtue that it’s an actual portfolio.”

Their analysis and comparison with hypothetical portfolios revealed several features of Keynes’s collection with implications for the broader market. One is the importance of the purchase channel. Keynes’s “winning lottery tickets”—in art world terms, paintings and drawings by the likes of Degas, Cezanne, Picasso, and Braque—were largely purchased at auction, where Spaenjers guessed he was able to spot bargains. (Incidentally, Keynes was also known to be an excellent stock picker.) The works he acquired through other channels, through dealers and on the primary market, underperformed relative to his auction purchases. Of course, Keynes wasn’t simply lucky; he had what today’s hedge funders call “edge,” insider tips shared through artist friends, including his one-time lover, the English painter Duncan Grant. Spaenjers said Keynes also appeared to time his purchases well, for example, buying works by van Dyck at auction when prices were low, or buying in Paris after World War I when the market was likely depressed.

Another characteristic of Keynes’s portfolio is its high level of concentration, with 80% of his total art spend going to just 10 works. In 2013, the 10 most valuable works accounted for 91% of the portfolio’s total value. “Changes in the total value of the Keynes collection are largely driven by changes in the market value of a few artists, such as Braque, Cezanne, Matisse, Picasso and Seurat,” the authors concluded. “Conversely, what happens to all the lesser-known artists…is not an important driver of returns.” Keynes’s portfolio performance points to an enduring quality of the broader art market (and, increasingly, the economy at large), that it’s a “superstar economy,” in which works by a few highly sought-after artists reap outsized returns. For example, the 20 best performing artists at auction have changed little over the past decade, topped by perennial names like Andy Warhol, Bruce Nauman, and Pablo Picasso, according to The Art Market | 2017, a recently released report from Art Basel and UBS.

Savvy art investors, at this point, likely know that executing a “buy low, sell high” strategy is easier said than done, given that so few young artists go on to command serious prices at auction. But even a portfolio diversification strategy (the idea behind mutual funds that hold a wide array of equities) is hard to implement when it comes to art, as this study highlights. When so much of the value of Keynes’s portfolio lay in a handful of key works, and buying them required significant upfront investment, successful arts investment appears to be a game for the already well-capitalized.

Still, the opacity of the art market does leave potential for well-positioned and deeply informed insiders to take advantage of information asymmetries, such as knowing when a work might become available or where a willing buyer lies. And in the study’s simulated portfolios, constructed at random from a global database of auction transactions, roughly a third of even small portfolios outperformed the equity market, a function the wide range of performance (most of them significantly underperformed). The key variable, of course, was the presence or absence of one of the “lottery ticket” artists in the hypothetical portfolio.

“There’s such wide variation that you can’t really conclude [Keynes] was ‘skilled,’” said Spaenjers. “But what you do see from reading about his life and his decisions is that he was given advice by his artist friends. It’s the type of edge that probably still could today play a role, especially in the contemporary market.”