Tony Hetherington is Financial Mail on Sunday’s ace investigator, fighting readers corners, revealing the truth that lies behind closed doors and winning victories for those who have been left out-of-pocket. Find out how to contact him below.

N.S. writes: I invested £9,000 with art firm Smith & Partner Ltd after it cold called me and was very persistent.

Two salesmen said demand for prints by the artist Miss Aniela was so great it would be no problem to exit within a week, and I was very likely to see strong returns within a year.

However since requesting a sale I have been given a series of excuses.

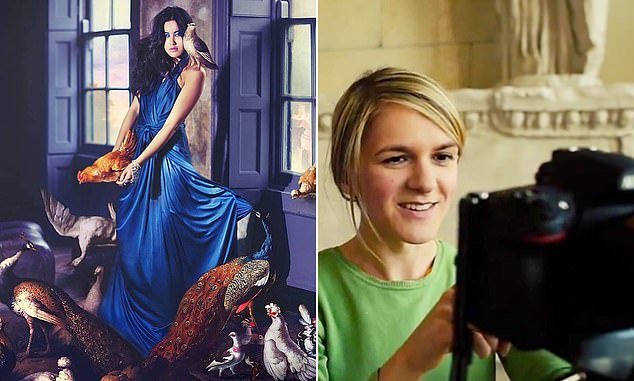

Flight of fantasy: A print from art photographer Miss Aniela (pictured right)

Tony Hetherington replies: Since I first sounded the alarm over Smith & Partner a few months ago, complaints have flooded in. The company’s long record of false claims and broken promises make it remarkable that it has not been investigated by Trading Standards, if not the police.

You have told me that recently, Smith & Partner even tried to sell you more work by Miss Aniela, claiming that it would be easier to sell a larger portfolio of her prints, and that as she is due to have a baby, values would rise even more as there would be a lack of new work from her.

Both these claims are untrue. Lots of Smith & Partner customers have told me that they were sold more prints for thousands of pounds as a condition of selling their whole collection at auction. Once they forked out, they were told the auction had fallen through.

As for Miss Aniela, who does produce some very attractive surreal pieces, her real name is Natalie and her partner Matt Lennard says she is not expecting a baby.

Lennard, who is also her producer, told me: ‘We hope any investor will research first before purchasing.

‘We would like to think the value of our work will increase, but nothing in life is guaranteed. Any investment is a risk.’

Sensible advice. Armed with your signed consent, I asked Smith & Partner’s owner, Luke Sparkes, to hand over all the recordings of his company’s sales calls to you.

He had told me that every customer was recorded agreeing to the terms of their purchase. This turned out to be another false claim, with Sparkes finally admitting: ‘Smith & Partner do not record our phone calls’.

Earlier falsehoods include the claim that Smith & Partner is a member of the respected Fine Art Trade Guild.

The truth? It was kicked out ages ago. Another false claim was that investors were never promised profits. The truth? Its own advertising said profits were ensured.

There is good news for you though. Luke Sparkes says he has sold Smith & Partner and quit as its director.

The new boss is Michael Conway. He told me: ‘As you know, I was not in charge when this deal took place. However, after speaking with the client, I have come to the decision to ensure the stock is sold by the end of next week.’

If this does not work out, tell me.

Debt collectors called in after meter blunder

Ms A.B. writes:- In 2019 it became clear I was being overcharged by Scottish Power. I stopped paying. In 2020 it sent an engineer, who found I was being billed for the wrong meter.

It then took Scottish Power a further year to agree with its own engineer.

Meanwhile it refused to recalculate my bills and pursued me for the balance shown by the wrong meter.

Confusion: An engineer found A.B. was being billed for the wrong meter

Tony Hetherington replies: You told me that when Scottish Power demanded you pay for someone else’s consumption, you appealed to Ombudsman Services, the private firm that referees complaints. It ruled that Scottish Power was to issue fresh bills, but only from June 2020 on.

This was not ideal, but you agreed to it to put the matter behind you. You set up a payment plan to clear arrears as well as paying for normal monthly usage.

But Scottish Power recently called in debt collectors, denied a payment plan existed, then conceded that the plan did exist – but refused to call off its debt collectors.

Scottish Power told me it used debt collectors because you failed to make the first payment due under the payment plan. When I challenged this, Scottish Power admitted it had actually failed to collect payment ‘due to a system error’.

By then, you had been pushed into handing over 36 monthly payments in just three months. Scottish Power told me: ‘We are sorry for the distress and inconvenience Ms B has experienced.’

It has provided a goodwill payment of £400 for the initial meter problem and a further £100 for falsely setting debt collectors on to you.

If you believe you are the victim of financial wrongdoing, write to Tony Hetherington at Financial Mail, 9 Derry Street, London W8 5HY or email tony.hetherington@mailonsunday.co.uk. Because of the high volume of enquiries, personal replies cannot be given. Please send only copies of original documents, which we regret cannot be returned.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.