To the annoyance of some shareholders, Shubhlaxmi Jewel Art Limited (NSE:SHUBHLAXMI) shares are down a considerable 26% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 72% share price decline.

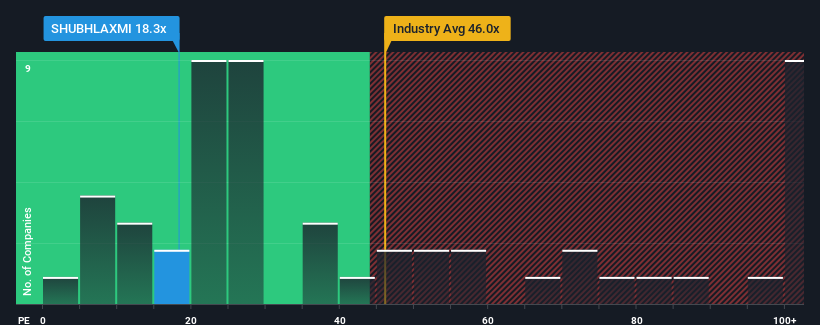

Since its price has dipped substantially, Shubhlaxmi Jewel Art may be sending bullish signals at the moment with its price-to-earnings (or “P/E”) ratio of 18.3x, since almost half of all companies in India have P/E ratios greater than 34x and even P/E’s higher than 64x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it’s justified.

The recent earnings growth at Shubhlaxmi Jewel Art would have to be considered satisfactory if not spectacular. It might be that many expect the respectable earnings performance to degrade, which has repressed the P/E. If you like the company, you’d be hoping this isn’t the case so that you could potentially pick up some stock while it’s out of favour.

View our latest analysis for Shubhlaxmi Jewel Art

Although there are no analyst estimates available for Shubhlaxmi Jewel Art, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

How Is Shubhlaxmi Jewel Art’s Growth Trending?

The only time you’d be truly comfortable seeing a P/E as low as Shubhlaxmi Jewel Art’s is when the company’s growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a worthy increase of 3.4%. Still, lamentably EPS has fallen 28% in aggregate from three years ago, which is disappointing. Therefore, it’s fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market’s one-year forecast for expansion of 25% shows it’s an unpleasant look.

In light of this, it’s understandable that Shubhlaxmi Jewel Art’s P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Final Word

Shubhlaxmi Jewel Art’s recently weak share price has pulled its P/E below most other companies. Typically, we’d caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Shubhlaxmi Jewel Art revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won’t provide any pleasant surprises. If recent medium-term earnings trends continue, it’s hard to see the share price moving strongly in either direction in the near future under these circumstances.

You need to take note of risks, for example – Shubhlaxmi Jewel Art has 6 warning signs (and 4 which are a bit concerning) we think you should know about.

It’s important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com