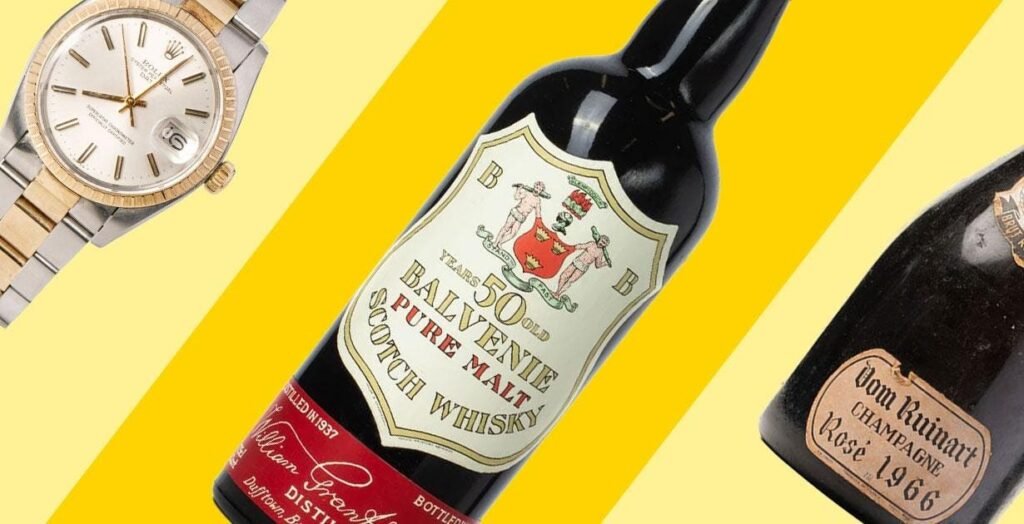

Are alternative assets like whisky, wine, watches, and art really in decline, or just resetting?

Mark Littler LTD

Gen-z have stopped drinking and it’s destroyed the whisky market. Or at least that’s what some recent headlines seem as though they’re saying. This is despite the fact that Diageo’s recent results are encouraging and clearly show stabilization, if not full growth. But if the whisky market is down because people aren’t drinking, then why are the changes in the whisky market so closely correlated to the wine, watch and art market?

You (probably) won’t get anyone suggesting that gen-z have stopped telling the time. Yet the data from comparable indexes over whisky, wine, watches and art all tell a similar story over the last few years. Does this mean all alternative assets are dead in 2025? I spoke to experts from LivEx, Watch Charts and ArtPrice to see what was happening.

Noticing A Trend

“The market peaked in October 2022, and has since fallen 27%. This is the longest and now the deepest downturn the fine wine market has experienced in the past 25 years,” explained Tom Burchfield, Head of Market Intelligence at LivEx, the exchange for fine wine, market data and insight when I reached out to him over email.

Liv-ex Fine Wine 1000: Market peak in October 2022, followed by a 27% decline — the deepest downturn in 25 years.

liv-ex.com

I contacted Tom to see what was happening in other alcohol markets, but I was surprised at just how closely correlated the LivEx data was with the Mark Littler 999 whisky index—an index that tracks the 999 most traded bottles of whisky on the secondary market. I decided to reach out to more experts in the markets of other alternative assets and the same picture came back.

Hamza Masood, Head of Partnerships at Watch Charts, the world’s leading secondary watch market research platform, explained over email how: “The [watch] market peaked in April 2022, and has declined by 33% since then, as measured by our Overall Market Index.” Jean Minguet, Head of Art Econometrics at Artprice, had a similar tale to tell from the data across their art markets: “Our Global Index shows a surge in art prices in 2021, just after Covid-19, followed by a slow decline. This gradually brought the index to its lowest level in 25 years.”

The WatchCharts index shows a steep correction from its 2022 highs, mirroring trends across wine, whisky, and art.

WatchCharts.com

“The whisky market’s downturn isn’t unprecedented, it’s the natural cycle of a maturing asset class,” says Trevin Lam, Founder of Spirits Invest. “Like wine and watches, speculative buying during Covid exaggerated the highs, and the subsequent correction has brought prices back to more sustainable levels. Long-term fundamentals remain strong.”

It was an intriguing set of data, and got me thinking. In the alcohol and spirits sectors all we are hearing is how tee-total gen z, zebra striping and low alcohol are killing the market. But looking at the data from whisky, wine, watches and art indexes layered over each other it seems clear they’ve all experienced a very similar pattern over the last three years. Changes in drinking habits certainly can’t explain a drop in the watch and art markets. But global economic uncertainty can.

The Great Market Booms

In 2018 the Macallan distillery made national news for causing tailbacks on the road for people queuing to get the distillery exclusive Genesis. The $670 (£495) bottle sold for over $6,000 when it reached auction in September 2018. In spring of 2019 the Knight Frank Wealth Report launched the whisky market into the limelight: Their whisky index showed 40% growth in 2018 and 582% over the previous ten years. The rest of 2019 saw a cooling as the market took a breath, but then a bottle of whisky made more than $1.5 million at Christie’s London in November. In 2020 I brokered the sale of a 42 bottle collection of Macallan 18 year olds that had been collected by a father for his son, the sale made international news when it sold for $59,000 (£44,000), some of them still had their £27 price labels on. Whisky was making people money. Then the Covid-19 pandemic hit and people suddenly had nothing to do, and nothing to spend their money on.

Spirits Invest data shows the 999 Index peaking in 2022, before falling in line with wine, watches, and art.

Spirits Invest

Some people bought whisky, others bought wine, or watches, but it’s all the same kind of drivers: inexperienced consumers pushing up prices and reinforcing their own dreams. It was great until the world changed and those consumers left because that money was needed elsewhere. However they didn’t just leave with their assets, they sold up, flooded the market and compounded the issue. Prices plummeted, people got scared and more people sold… It’s a tale as old as the markets themselves.

Common Market Themes

When I spoke to each of the experts in their own markets it became clear that they had all experienced something similar. Watches, wine and art all shared striking similarities with whisky: Their markets had been growing prior to the pandemic, but in the immediate aftermath of the covid pandemic consumers had money to spend and this drove prices to record highs.

“Flippers were a major contributing factor for both the rise and fall of the watch market; at first driving up prices and then contributing to the decline by flooding the market with excess inventory as they tried to cut losses.”

The abundance of wealth that drove peaks in the whisky market also drew people to the art and fine wine markets too. Minguet of Artprice explained, “It seems that art has been the subject of particular enthusiasm around 2021, fueled by a wealth of available money.” And Tom of LivEx had a similar story: “To a degree a broadening of interest in fine wine due to covid lockdowns and cheap money did spark a surge in speculation into the wine market.”

Artprice Global Index: A surge in 2021 followed by a gradual decline to its lowest level in 25 years.

Artprice.com

Speaking to these experts and looking at the data it’s clear that both watches and art have experienced similar patterns to the whisky and wine market. But no one is claiming that the world is turning away from art or not bothered about telling the time. They simply assess that consumers are buying less watches and art because they have less money to spend on those things.

A Shift To No And Low Alcohol?

The drops across all the markets I assessed were exacerbated by the boom that came before; the combination of the loss of the additional buyers to the market alongside larger economic changes. Rather than being taken as a sign that these alternative assets no longer have value, these are simply cycles in a maturing market.

Rather than the doom and gloom picture painted across wine, beer and spirits at the moment, which largely claims gen-z are just drinking less, perhaps the answer is that they are drinking less because they have less money to spend on booze? Alcohol doesn’t have to be a luxury, but it is something that people don’t need and there are ways to cut back like buying less or going for the cheaper option over your favourite brand.

Scotch whisky as a drink is increasingly premiumised and you can see the impact this has on consumers in Diageo’s most recent report: scotch is down but the accessibly priced Crown Royal is up. People are still drinking whisky, they’re just drinking differently.

What Does This Mean For The Whisky Market?

What does that mean for your whisky collection? There are signs of stabilization in both the primary and secondary markets as Diageo’s most recent results show unexpected positivity and the MLL999 index shows a slowing market that hopefully indicates the bottom of the drop. There are similar notes of positivity from the other markets too.

“We are seeing some early indications of some green shoots in Asia, certain recent vintages have now corrected to levels that look sensible,” said Tom on the outlook for the current outlook on the wine markets. “There are still some hurdles to overcome—US tariffs are still uncertain, although it looks like 15% is now the worst case scenario. Overall, there is still uncertainty, and one would expect that a lengthy period of stabilisation before confidence returns and prices might start to tick up.”

For whisky it is important to remember that the secondary market is still up over ten years, more or less back at 2019 prices. If you bought before 2019 and you need to sell… then that’s the right choice for you. If you bought more recently I’d suggest holding whatever asset it is as long as you can with the aim to ride out this low. And if you are an educated investor, whichever market you’re in, buying when others are fearful is often the most profitable way to go.