Investors burned by plunging stock markets in Europe are increasingly turning to the art market, according to Christie’s.

The London auction house, which traces its roots back to 1766, has reported record sales of £3.6bn last year, a 9% increase on 2010.

Postwar and contemporary works, by artists including Roy Lichtenstein, Andy Warhol and Mark Rothko, proved the most popular – raising £735m, a 22% increase on the previous year.

“Investors are entering the market and existing collectors are buying more,” said Steven Murphy, Christie’s chief executive.

“While we are seeing more investors collecting, there are many more collectors who are increasing their investment in their collections as the explosion of interest in art, fuelled by globalisation, facilitated by the technology that increases access to information and images, meets the art that is coming to the market.”

The auction house said first-time buyers increase by 12%, and demand from China and Russia continues to grow.

Chinese buyers accounted for 13% of sales last year, a 2% increase on 2010, and the number of customers from Russia and former Soviet Union countries increased by 15%.

Murphy said international trade had been boosted by the company’s revamped Christies.com website.

Traffic to the site increased by 77% last year, and almost one in three bids were placed online.

However, customers are still reluctant to buy the most expensive paintings through the internet – just two of the 719 works that sold for more than $1m (£630,000) were bought via online bidding.

The most expensive single lot last year was Lichtenstein’s 1961 I Can See the Whole Room … and There’s Nobody in It!, which sold for $38.4m at Christie’s New York saleroom in November.

The top lot in London was the historic racing painting, Gimcrack on Newmarket Heath with a Trainer, a Jockey and a Stable Lad by George Stubbs, which made £22.4m. Total sales at the UK headquarters were £871m.

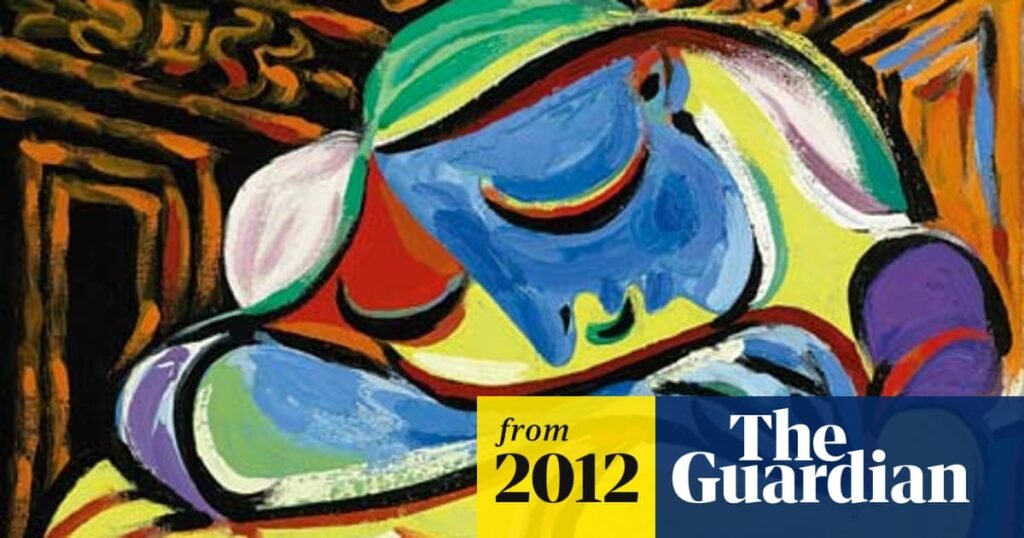

Pablo Picasso’s 1939 painting, Femme Assise, Robe Bleue, was the top impressionist and modern seller, fetching £18m in London in June.

Murphy said he remained optimistic about the market in 2012.